Becoming a helicopter pilot is an exciting and rewarding pursuit, but there’s no avoiding one of the biggest challenges students face: the cost.

Unlike many college programs where financial aid systems are familiar and widely advertised, helicopter flight training falls into a hybrid space between vocational education and aviation certification. Unless you are planning to use your savings or a line of credit to pay for flight training, understanding your financing options can make the difference between putting your dream on hold and making it a reality.

This guide breaks down what every student needs to know about paying for a helicopter pilot program in the U.S., including realistic costs, payment methods, loan options, grants, and creative strategies to fund your education.

What Are the True Aviation Training Costs?

The total cost depends on the license path you choose. Here’s a breakdown of common programs:

- Private Pilot License (PPL-H)

Average: $15,000-$30,000

Required to fly non-commercially.

- Commercial Pilot License (CPL-H)

Average: $50,000-$80,000 (including PPL)

Required for paid aviation work.

- Instrument Rating

$10,000-$20,000

Increases employability and safety.

- Certified Flight Instructor (CFI/CFII)

$5,000-$15,000

Often used to build hours toward employment.

Students pursuing a full professional track often spend $70,000-$100,000+ before they’re job-ready. Because helicopter programs are typically not federally subsidized like four-year colleges, you need a financing plan.

Can You Use Federal Financial Aid?

It depends on the helicopter flight school. Independent helicopter academies typically are not Title IV eligible, meaning students can’t use traditional federal student loans or Pell Grants. However, flight training programs affiliated with community colleges, trade schools, or universities may qualify.

If attending an accredited institution with FAA Part 141 approval, you may be eligible for:

- Federal student loans

- Grants

- FAFSA-based aid

- Work-study (in limited cases)

Always ask the school if it participates in Title IV programs.

Private Pilot Training Loans

For schools that don’t qualify for federal aid, private lending is a common path. Popular lenders include:

- Sallie Mae

- Meritize

- Wells Fargo (aviation-specific partners only)

- Credit unions

Terms usually depend on credit score, income, and co-signers. Interest rates vary, and repayment typically begins after graduation or a grace period.

VA Benefits (GI Bill®)

For veterans and eligible dependents, the Post-9/11 GI Bill® may cover a large portion of helicopter pilot training. To qualify:

- The program must be VA-approved

- Usually requires Part 141 certification

- Benefits may differ for degree vs vocational programs

Some schools also offer Yellow Ribbon Program support to bridge funding gaps.

Aviation Scholarships and Grants

While less common than fixed-wing scholarships, helicopter-specific aid exists through:

- Whirly-Girls Scholarship Fund

- Helicopter Association International (HAI)

- Experimental Aircraft Association

- Local aviation clubs

- Corporate aviation partnerships

Even a $2,000-$10,000 award can significantly offset training hours.

Pay-As-You-Go vs Upfront Packages

Some students pay per flight hour as they train. Others take advantage of financing plans offered directly by schools. Package payments may offer discounts, but ensure funds are escrowed or protected in case of school closure.

Personal and Creative Financing Options

Students often supplement formal loans with:

- Savings or retirement withdrawals (with caution)

- Family assistance

- Employer sponsorship

- Side jobs or gig work

- 529 education plan disbursements (if the school qualifies)

Some trainees combine part-time training with full-time employment to minimize monthly loan amounts.

What About Working as a Student?

Unlike traditional college, helicopter training doesn’t offer campus jobs. However, some schools hire students for:

- Administrative support

- Hangar work

- Dispatching

- Fueling and ground crew tasks

You may also qualify for reduced rates by serving as a future flight instructor.

Budgeting Beyond Tuition

Your financing plan should account for:

- Ground school materials

- Headsets and gear ($500-$1,500)

- Examiner fees

- Checkrides

- Written test fees

- Insurance

- Travel or housing if relocating

Unexpected delays (like weather or instructor availability) can add extra hours and cost, so planning a buffer is essential.

Choosing a School with Financing Support

Before committing, ask each flight school:

- Do you partner with any lenders?

- Is your program Title IV or VA-approved?

- What’s the average total cost for commercial certification?

- Do you help students apply for loans, grants, or scholarships?

- Do you offer payment plans?

Schools with dedicated financing advisors can save you thousands.

The ROI of Helicopter Training

Yes, the investment is substantial, but so is the potential return. Entry-level helicopter pilots (often as CFIs) typically start around $45,000-$60,000/year, with experienced pilots earning $70,000-$120,000, depending on the job sector:

- EMS

- Tours

- Utilities and firefighting

- Offshore transport

- Law enforcement

A smart financing strategy ensures your loan payment aligns with your future income.

FAQ

Can I get federal student loans for helicopter pilot training?

Only if your training is through an accredited Title IV school, such as a college or university partnered with a Part 141 helicopter program. Independent flight schools usually don’t qualify.

What’s the average total cost to become a professional helicopter pilot?

Most students spend $70,000-$100,000+ to go from zero experience to commercial certification with instructor ratings. This will vary depending on the school.

Are private loans a common option?

Yes. Many students use private lenders like Sallie Mae, Meritize, or credit unions. A co-signer can improve approval odds and reduce interest rates.

Can veterans use the GI Bill®?

Yes, if the program is VA-approved. Benefits vary based on enrollment length and whether the program is degree-based or vocational.

Are scholarships available?

Yes, through organizations like Whirly-Girls, Helicopter Association International, and aviation nonprofits. Awards may cover specific ratings or hours.

Do flight schools offer in-house financing?

Some partner with third-party lenders or create installment plans. Always review contract terms and refund protections.

Do I need good credit to get financing?

Most private loans require a credit check. Co-signers can help students with limited or poor credit history.

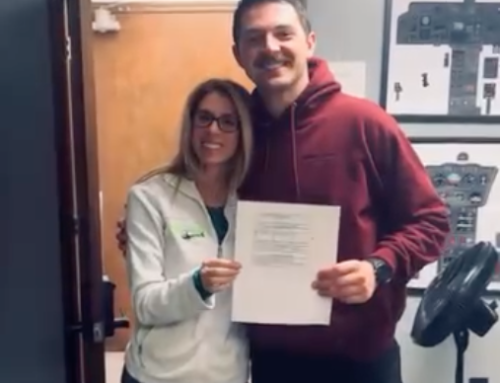

Helicopter Pilot Program – Get Financing For Training With Higher Ground

The useful thing about doing the helicopter pilot program with Higher Ground is that our classes are held 2-3 times a week at night from 6 to 9 pm or 7 – 10 pm. This means you can work full-time at another job and support yourself financially for this program. We are also a pt.141 School associated with Sinclair Community College.

We also offer opportunities for financial aid, grants, and GI Bill® benefits for students enrolled in the degree program. We ensure our students are trained at the highest level possible, which results in a higher first-time pass ratio.

Contact our team to learn more about our program today.